Сдача недвижимости в аренду на Северном Кипре — это прибыльное занятие, которое требует внимательного подхода к соблюдению налогового законодательства. Власти усилили контроль, чтобы минимизировать уклонение от уплаты налогов, а также ввели новые правила, которые арендодателям необходимо учитывать.

Налоги при аренде недвижимости

Ставки налога зависят от условий договора и валюты:

• 8% — для договоров в турецких лирах.

• 13% — для договоров в иностранной валюте (например, евро или доллары).

• Дополнительно взимается 1,5% в фонд помощи пострадавшим от землетрясений.

Налог рассчитывается на основании суммы аренды, прописанной в договоре. Однако налоговая служба теперь оставляет за собой право пересматривать эту сумму, если посчитает её заниженной.

Долгосрочная аренда

Если вы сдаёте недвижимость в долгосрочную аренду, налог составляет от 8% (при оплате в турецких лирах) до 13% (при использовании иностранной валюты) от арендной платы, указанной в договоре.

Регистрация договора

Договор обязательно должен быть зарегистрирован в налоговой службе вашего района. За регистрацию взимается плата в размере 0,5% от общей суммы аренды.

Пример:

Если договор заключён на год, а месячная арендная плата составляет 20 000 лир, налог на регистрацию будет рассчитан от суммы 240 000 лир и составит 1200 лир.

Краткосрочная аренда

При краткосрочной аренде ставка налога остаётся такой же — 8% или 13%, в зависимости от используемой валюты.

Особенности оплаты:

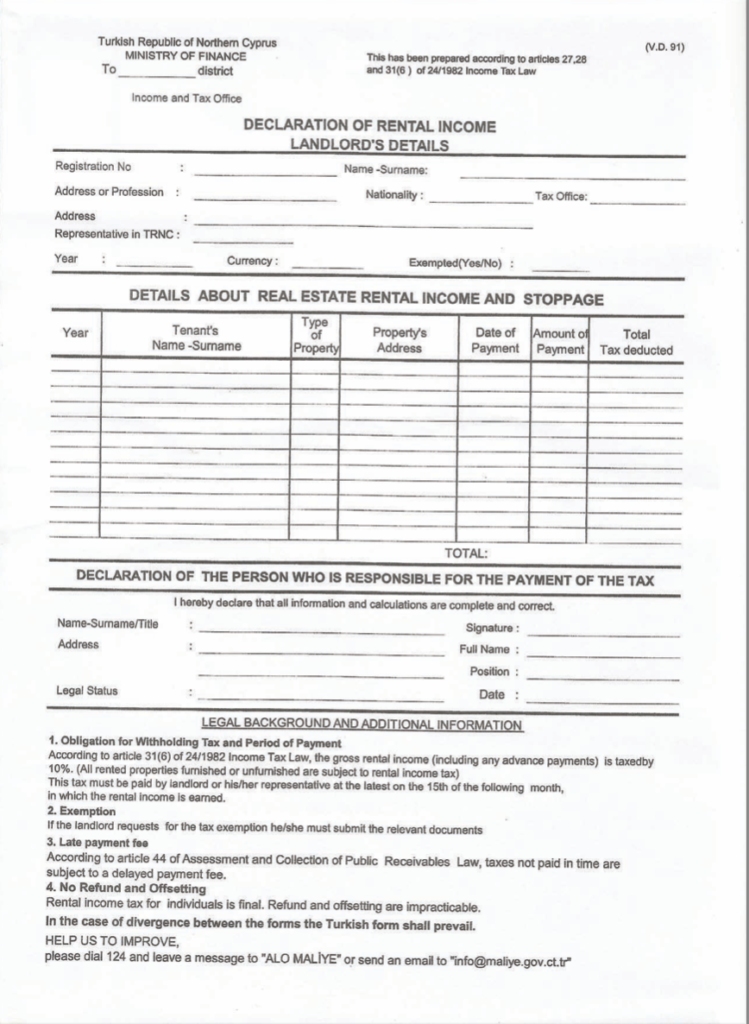

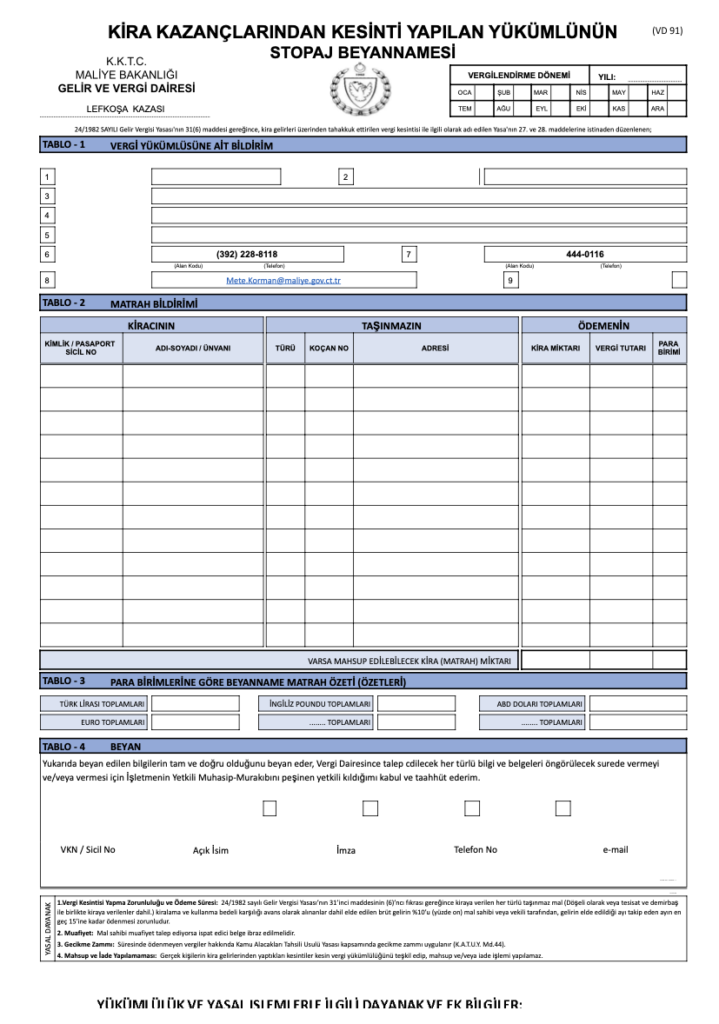

• В налоговой потребуется дополнительно заполнить форму V.D.91 (выдаётся на месте).

• Арендодателю важно учитывать, что этот вид сдачи также должен быть задекларирован.

Документы для регистрации договора

Для сдачи в аренду необходимо подготовить следующие документы:

1. Декларация дохода с аренды.

2. Форма V.D.91 (для краткосрочной аренды).

Ужесточение контроля налоговой службы

В случае, если налоговая обнаружит, что сумма аренды в договоре занижена, арендодателю грозят штрафы.

Часто задаваемые вопросы (FQA)

1. Нужно ли платить налог, если я сдаю недвижимость родственникам?

Да, налоговая служба требует оплаты налога с аренды независимо от того, кому сдается недвижимость, включая родственников. Важно зарегистрировать договор и указать реальную сумму аренды.

2. Как подтвердить уплату налога на аренду?

После оплаты налога вам выдается квитанция, которая служит официальным подтверждением. Она может понадобиться для дальнейших расчетов или при проверке налоговой службы.

3. Что делать, если арендатор отказывается платить?

Если арендатор не выполняет свои обязательства по договору, это не освобождает вас от уплаты налогов. В таких случаях вы можете обратиться в суд для разрешения конфликта, но налог должен быть уплачен своевременно.

4. Нужно ли регистрировать краткосрочные договоры аренды?

Краткосрочные договоры аренды также должны быть зарегистрированы, особенно если вы сдаете жилье через платформы бронирования. Это обязательное требование налоговой службы.

5. Могу ли я оплатить налог с аренды онлайн?

Некоторые налоговые службы предоставляют возможность оплаты через интернет. Уточните в налоговой службе вашего района, есть ли такая опция, и подготовьте необходимые документы для онлайн-оплаты.

6. Когда нужно оплачивать налог с аренды?

Оплата налога должна производиться до 15 числа следующего месяца после заключения договора. Либо налог можно оплатить сразу за весь период аренды во время регистрации договора.

7. Что делать, если договор расторгнут раньше времени?

Необходимо уведомить налоговую службу о расторжении договора. Если это не сделать, налог продолжит начисляться, а за его неуплату будут взиматься штрафы и пени.