In recent years, digital currencies have revolutionized many areas of our lives, providing new opportunities not only for investing, but also for paying for goods and services. Bitcoin can rightfully be considered the father of cryptocurrency. The blockchain system created on its basis makes any transactions open, inexpensive and fast. But despite the obvious advantages of cryptocurrencies, it took more than 10 years from the moment the first block of Bitcoin was recorded for transactions with it to come to the real estate sector)

The first attempt to conduct a purchase and sale transaction for BTC took place in 2013 in Canada. The real transaction for cryptocurrency took place only in 2017. Subsequently, due to taking into account geopolitical factors, restrictions at the level of government agencies in different countries and the period of the COVID pandemic, cryptocurrency became firmly established not only among qualified crypto enthusiasts, but also among ordinary people.

Every year the list of states that have recognized the practical benefits of cryptocurrencies is expanding. The very first in the world was El Salvador, which in September 2021 legalized Bitcoin as a means of payment and began buying cryptocurrency. By the way, as of 2024, El Salvador’s profit, taking into account the increased BTC rate, amounted to over 3 million US dollars. Countries such as the United Arab Emirates (UAE), France and Spain allow the legal use of cryptocurrency as a means of payment when paying for car rentals. Germany, Thailand and Southern Cyprus allow transactions between individuals and real estate companies for cryptocurrencies.

Now let's take a closer look at how cryptocurrency transactions are carried out using the example of specific countries.

Portugal: An Oasis for Crypto Investors

Portugal stands out for its loyalty to cryptocurrencies. The country has not only exempted transactions with crypto assets from taxation, but also allows you to register real estate transactions when transferring coins directly to the seller, which makes it attractive to crypto investors.

UAE: Innovation in tradition

In the UAE, despite the ban on direct payments in cryptocurrencies, there are mechanisms that allow real estate transactions to be carried out through the conversion of crypto assets into fiat money.

Typically, developers or brokers interact with cryptocurrency exchangers, whose commission ranges from 1 to 3% of the exchange amount. Since you can bring up to $10,000 in fiat money, and the execution time for bank SWIFT transfers can last from several weeks to a month, cryptocurrency transactions through exchangers are one of the frequently used methods for fast and reliable money delivery. This highlights the country's flexibility and innovative approach to new financial instruments, making the real estate market accessible to crypto investors.

Thailand: Balance between innovation and regulation

Thailand, having adopted the legalization of cryptocurrencies in 2018, took a conservative position in 2022, banning the use of digital coins as a means of payment, but without reducing interest in investment in this area. Established practices include working through intermediaries and P2P platforms to conduct transactions, which allows you to bypass restrictions and maintain interest in crypto real estate investments.

Local real estate agencies and developers offer several methods. The client transfers the cryptocurrency to the intermediary’s wallet, which in turn, minus a commission, makes a transfer to the client’s account from the intermediary’s foreign account, or in some cases, funds are deposited by the intermediary on behalf of the buyer directly to the account of the developer or seller.

The second version of the transaction is through the P2P service of the exchange: the buyer from Russia sends rubles to the intermediary’s bank account opened in the Russian Federation, after which the intermediary transfers the currency to the developer. The exchange acts as a guarantor of the execution of this financial transaction, retaining a commission of 5 to 10% as a reward for the service provided.

Germany: Full recognition

Germany is at the forefront of cryptocurrency acceptance, having fully legalized Bitcoin transactions. The German real estate market is open to crypto transactions, making the country one of the most attractive European destinations for crypto investors.

Georgia: Uncertainty and opportunity

Georgia, without clear regulation of crypto payments, represents a field of opportunity for investors. Investments are tax-free, which, coupled with the lack of strict restrictions, creates an attractive environment for crypto transactions. Payments in cryptocurrency are not prohibited, but contracts cannot indicate the valuation of real estate in cryptocoins. Investors first exchange crypto assets for fiat money through intermediaries (exchangers).

Montenegro: Balkans Crypto Center

Montenegro demonstrates a loyal attitude towards cryptocurrencies, allowing the purchase of any goods, including real estate, with digital assets. This desire to become the region's crypto hub reflects the country's macroeconomic strategies to attract foreign investment.

Singapore: Open to Innovation

Singapore, by recognizing cryptocurrencies and not taxing transactions with them, maintains its image as one of the most innovative financial centers in the world. The purchase and sale of real estate for crypto assets without the participation of intermediaries emphasizes the country’s openness to new financial instruments.

Republic of Cyprus: Regulatory stringency

In Southern Cyprus, unlike many European countries, crypto-currency transactions in real estate are prohibited. The country's central bank actively opposes the use of digital assets in payments, which forces developers and buyers to resort to the services of real estate agencies to convert crypto assets through foreign exchanges.

Türkiye: Demand under constraints

Despite the ban on calculations in cryptocurrencies, Turkey remains high demand for digital assets due to economic conditions. Private real estate transactions in which assets exchange on the exchange allow you to get around restrictions and maintain interest in crypto investments. This is facilitated by high inflation in the country of local payment funds - the Turkish lira. Only from 2023 to April 2024, the accounting rate of the Central Bank of Turkey increased from 7.5 to 50%.

Therefore, not only foreign investors, but also the local population of Turkey, which is no less than 8 million people, prefer to store their savings in digital assets. The procedure for purchasing real estate for cryptocurrency usually looks like this: a purchase and sale agreement in currency or Turkish lira is drawn up between the seller (developer or individual) and the buyer. The buyer, through intermediaries: an agent, exchange or exchanger, exchanges digital coins for fiat money, which transfers to the seller independently or through an agency.

Transaction fees range from 4 to 5%. After transferring the money to the seller, the notary certifies the purchase and sale agreement and sends it for registration, followed by issuing a TAPU certificate of title to the buyer.

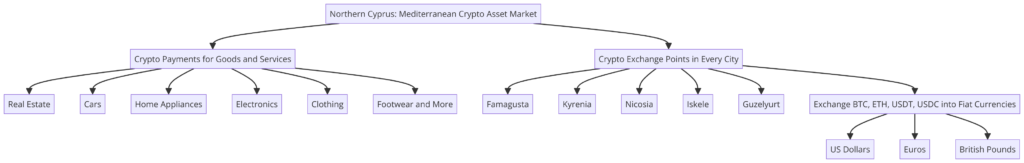

Northern Cyprus: Mediterranean cryptoasset market

The Turkish Republic of Northern Cyprus (TRNC) has advanced the furthest in this direction, allowing mutual settlements in cryptocurrency not only for real estate, but also for other types of goods and services: cars, household appliances and electronics, clothing, shoes, etc. In each city of Northern Cyprus: Famagusta, Girne, Lefkosa, Iskele or Guzelyurt, you can count more than a dozen different cryptocurrency exchange points.

You can safely come to any of them and exchange BTC, ETH coins or USDT or USDC stablecoins for fiat currency: US dollars, euros or British pounds. Such companies are opened and registered with government agencies and operate completely legally. This type of activity does not require a special license, making this business accessible to foreign citizens, however, there are a number of conditions required to open a legal entity .

Why Northern Cyprus?

Northern Cyprus attracts the attention of investors due to its favorable geographical location, temperate climate, and, most importantly, loyal attitude to various types of means of payment. Since the island of Cyprus was previously part of the British colony, in addition to the norms of Anglo-Saxon law, payments, including for real estate, were preserved in British pounds.

The official currency of the Northern Cyprus is the Turkish lyre, at the same time in free circulation, the British pound, the euro and the US dollar are used and accepted as payment. Not disadvantaged and is popular with cryptocurrency - BTC and USDT.

Recent sanctions and other restrictions on the financial and banking sectors of individual countries, resulting in the impossibility of foreign investors making SWIFT transfers to Northern Cyprus, contribute to the intensification of crypto-currency transactions.

Advantages of buying real estate with cryptocurrency in Northern Cyprus.

The key advantages of such a purchase are the reduction in time for processing transactions, savings on bank commissions and the ability to avoid tax costs. Many developers in Northern Cyprus are ready to directly accept cryptocurrency from the buyer into their account opened on the exchange or cooperate with official companies involved in the exchange of cryptocurrency (crypto exchangers).

This makes buying real estate with cryptocurrency especially attractive to many investors, in particular from Russia and Belarus. The commission for transferring from cryptocurrency to fiat money, for example from USDT to US dollar, ranges from 1.5 to 3%.

Likewise, you can withdraw your money via cryptocurrency when selling property in Northern Cyprus, or deposit fiat money into a bank account and then send it via SWIFT transfer to the destination country where your personal account is opened.

How to choose real estate in Northern Cyprus to buy with cryptocurrency?

Choosing real estate is a process that requires careful study of the market, understanding your needs and capabilities. Recommendations for choosing an object, as well as the importance of professional legal support for the transaction cannot be underestimated.

Check with local developers about the possibility of paying for real estate with cryptocurrency. Contact official real estate agencies or licensed lawyers for legal support of the purchase and sale transaction.

Use the services of crypto exchangers registered in Northern Cyprus to exchange cryptocurrency into fiat money and back.

The process of buying real estate for cryptocurrency in Northern Cyprus

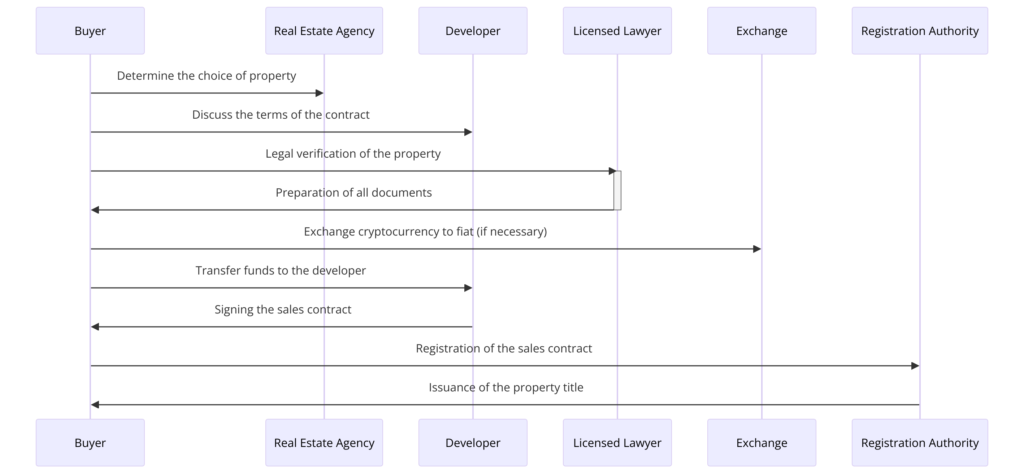

The stages of a transaction, starting from selecting an object to registering ownership, include a number of important steps that you need to know and follow correctly.

- First , independently or with the help of a real estate agency, decide on the choice of an area of Northern Cyprus, a complex, specific housing and a developer.

- Second , before concluding a purchase and sale agreement, discuss with the developer all the essential terms of the agreement, including the method and procedure for payment. To conduct a transaction and check its legal purity for various encumbrances on the property, we strongly recommend that you engage a licensed lawyer or law office. It will take the lawyer one week to a month to follow all the legal processes to get to the stage of both parties signing the purchase and sale agreement. In 2024, the procedure for concluding real estate transactions in Northern Cyprus was tightened at the legislative level, obliging the participation of lawyers in all transactions.

- Third, after checking the property and preparing all documents for entering into a transaction, the buyer transfers cryptocurrency (equivalent to the fiat value specified in the purchase and sale agreement at the exchange rate on the day of the transaction) directly to the developer’s account. If the developer does not accept cryptocurrency as a means of payment, the buyer exchanges cryptocurrency into fiat through intermediaries: an exchange or a crypto exchanger, and then deposits cash into the cash register or into the seller’s current account. To ensure transparency and security of financial transactions, the participation of a real estate agency and a lawyer will be important for the buyer. On the day the payment is made, the parties to the transaction sign a purchase and sale agreement.

- Fourth , the buyer, independently or through a lawyer or real estate agency (based on an issued power of attorney), within 21 days registers the purchase and sale agreement with the land registry and the tax authority at the location of the property, with payment of the appropriate taxes and fees

Risks of buying real estate with cryptocurrency in Northern Cyprus and how to minimize them

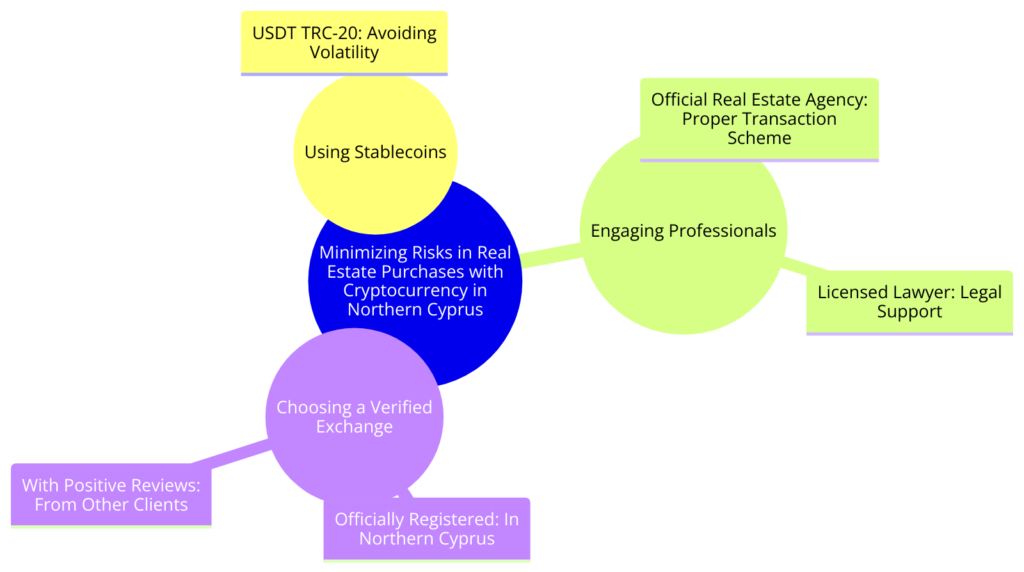

Like any financial transaction, buying real estate with cryptocurrency carries certain risks, including the volatility of cryptocurrencies and legal difficulties. Let's look at how you can minimize these risks.

- First , to avoid sharp exchange rate fluctuations in cryptocurrencies, use stablecoins, such as USDT TRC-20, for payments rather than BTC or ETH.

- Second , engage an official real estate agency and a licensed lawyer to complete the purchase and sale transaction, who will help you correctly draw up a transaction diagram and the procedure for making payments using cryptocurrency.

- Third , to exchange cryptocurrency into fiat money, contact only a digital currency exchanger that is officially registered in Northern Cyprus and has a legal address and physical office, as well as positive reviews and recommendations from other clients.

What do you need to know before buying real estate with cryptocurrency?

In Northern Cyprus, the value of real estate in sales contracts is fixed in fiat currency: Turkish lira, British pounds, euros and US dollars. Cryptocurrency can be used as a means of exchange for fiat money when purchasing real estate in Northern Cyprus. Cryptocurrency exchange points have been officially registered in Northern Cyprus to exchange digital assets into fiat.

What legal aspects should be taken into account?

Legislation in Northern Cyprus does not provide for payments in cryptocurrency for real estate with fixation of their value in purchase and sale agreements. At the same time, legal entities (exchange points) are legally opened and exist here, which can carry out cryptocurrency exchange operations.

Is it possible to get a mortgage in cryptocurrency?

No, in Northern Cyprus, mortgages and any types of installments in cryptocurrency are not practiced. From the developer or bank you can get an interest-free installment plan or a loan in fiat currency: Turkish lira, US dollars, euros or British pounds.

How is the security of such transactions ensured?

The most reliable way to ensure the safety of transactions of real estate purchase and sale using cryptocurrencies is to attract a licensed lawyer and an official real estate agency.

Is it possible to return cryptocurrency upon termination of a transaction?

No, there were no such precedents in Northern Cyprus, since the purchase and sale agreements usually specify the value of real estate in fiat money: Turkish lira, British pounds, euros or US dollars.

What are the predictions for the future of the real estate market using cryptocurrencies?

The real estate market of Northern Cyprus is developing more actively every year, offering future investors convenient, fast and reliable ways to transfer their money not only in fiat, but also in digital terms.

Conclusion: Looking to the Future

Buying property with cryptocurrency in Northern Cyprus opens up new horizons for investors looking to maximize the potential of digital finance. Having considered all aspects of such a purchase, it is safe to say that digital innovation in real estate is the future.